The concept of dieting or eating healthy is something many of us are striving towards or have attempted at some point in our lives. This often happens after the new year, a holiday season or prior to swimsuit season being thrust upon us.

Hey, we all want to look our best right? What may not be as well known or accepted is the idea of applying a diet when it comes to your money. As much as attempting to eat less can be good for your health, applying similar strategies to your wallet can also prove to be beneficial.

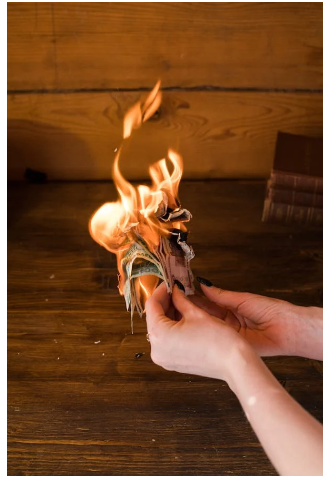

Just like the packet of Oreos we can’t seem to put down, money is often treated with no regard to the consequences. If you eat a whole packet of cookies, a stomach ache may follow to go along with the weight gain. The same can be said for the $300 you spend on a weekend going out with friends. The consequences may be different, but the end result is similar.

Guilt, remorse and dejection may follow. These are all easily remedied if you start with a budget and then make a plan for your money.

Make a Budget

Seriously, you’re going to tell us to make a budget? Yes. Yes I am.

If what I’ve read is true, a large number of Americans have absolutely no idea how much money they spend or where it goes each month. This sounds crazy to me. You either work too hard or did work hard (if you’re retired) to be clueless on your spending.

Write down (or type into a spreadsheet) your major expenses for each month (mortgage, car payment, utilities, etc). Once you’ve got this done, you should have a better grasp on how much money you have left over for everything else you’ll need or want to buy.

No amount of saving or attempting to be smart with your money works without a budget. This is the foundational element upon which all else is built. If you want to be better about managing your money and you don’t have a weekly or monthly budget, this is the first place you should start.

Have a 1, 3 and 5 Year Plan

If I’ve learned anything as I’ve gotten older, it’s that time has a way of flying by without you even realizing it. One day you’re in your twenties hanging out at a bar with your friends, the next day you’re 40-something mowing your backyard and attempting to avoid fecal landmines from the family dog.

Without an established plan for your money, you’ll have no idea what you’re working so hard to accomplish. Do you want to retire early? Are you trying to save for your kids to go to college? Do you want a new car in a few years? These are all pretty standard goals but how long will it take to achieve them?

Having short, mid and long term plans for your money provides you with the motivation needed to keep striving toward your end goal(s).

It’s no different than training for a marathon. You’re not going to start running 26.2 miles on the first day. Run that first half mile to get started and build from there. You can do the same thing with your money. Save that first $5 or $10 and stay true to your original goal. You’d be amazed at how quickly you can build up a nice little nest egg with a bit of discipline and spending avoidance.

Are you ready to get started?

Good.

Put down the Oreos and start typing.