Failure to plan is planning to fail. We’ve all heard the expression. It’s true with most things we do in life. Whether you’re figuring out where your next vacation will be or how much it will cost to replace the tires on your car, planning for the best (or the worst) case scenarios in life is a good way to stay ahead financially.

You’ll hear people tell you that having a budget is important. This is true of course. You should have an idea of where your money is going and what you’re spending it on. I would even suggest looking at your budget multiple times a day. Doing this will make you intimately familiar with all of your expenses so you can avoid financial pitfalls.

Budgeting is important, but planning for the future as part of your overall budget is crucial. Using the Dave Ramsey “emergency fund” method, you should always have cash at the ready for unforeseen expenses.

Having cash on hand is like having budget insurance. You have the ability to dip into your savings when something unexpected comes your way. Inevitably it will, because that’s what happens in our lives. Your child gets a broken arm and you have a bill for the ER trip that arrives a month later, your refrigerator goes out or you need a new lawn mower. You get the idea.

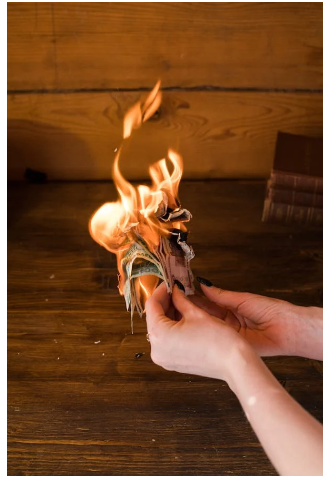

Too often, people rely on credit cards as their emergency fund. They dip into them as though they were cash on hand, ready to be used in order to kick the can on the expense rather than feel the pain now. Don’t be tempted. Credit cards are easy money that lead to ruin. Unless you can pay it off every single month, without fail, they provide zero benefit if you have the ability to pay with cash instead.

I remember getting my first bonus at work when I was around twenty three years old. I can’t remember the exact amount but I want to say it was around $1,500. At the time, I had about $4,000 in outstanding credit card debt, I had leased my car and I lived in an apartment. In other words, I had zero assets, rented everything I owned and owed money to the bank.

Rather than use the majority of my bonus to help pay down my credit card, I bought a boat instead. Along with the lease on my car, this was one of the dumbest financial decisions I would ever make in my life. Instead of planning for the future, I furthered my debt load by planning for what I perceived to be fun instead. It wasn’t. I had to give the boat up a few months later. I used it twice and owned it for less than 10 months.

The point is, I didn’t have a plan. I was gliding along figuring I was doing pretty good when I compared myself to my peers. The sad thing was, this was partially true. I knew plenty of people who were much further in debt than I was. Compared to them, I was doing great. What I didn’t realize was, I was going about it the wrong way.

You need to plan for YOUR future, not THEIRS. Who cares how far in debt they were compared to me? What matters is where I wanted to be in five, ten or twenty years. Thankfully, the boat and car lease fiasco opened my eyes about money early enough to where I could plan for my future and make better decisions.

Those two mistakes alone provided the learning experience I needed to fix my money problems and make better decisions in the future. In the twenty five years since, I’ve always had a plan in place for the money I currently have and will have down the road.

Don’t make the same mistakes I did.

Make a plan now.

Your future depends on it.