It’s incredibly easy to get into financial trouble. With the wave of easy credit that exists in America and the fact you can buy just about anything you want on Amazon, it’s no wonder many families are feeling the pinch. Couple this with inflationary prices and it’s important that we all take a look in the mirror and tighten our belts when we can.

One way my wife and I have found to be helpful is to not only discuss our finances frequently, but to have certain rules for spending. The biggest rule we have is to not buy anything over $50 without first discussing it with each other. I’ve mentioned this rule to other couples and most people think we’re nuts. “That’s a ridiculously low number,” is the usual response. The number isn’t really the point.

We all hear of couples who have separate bank accounts. You may even be one of those couples. I don’t get it but if it works for you have at it. I’ve always thought this was done as a way to hide large expenses. Perhaps it’s also because one person or the other within the marriage wants the freedom to buy what they want. Why else would you do it?

Finances in a marriage are tough, very tough. This is especially true when kids are involved. From diapers to daycare to college and everything in between, kids will put a massive dent on your bank account. Regardless of your financial situation, you’re either scrounging through the change drawer to pay for diapers or sending the kids off to summer camp. Regardless, you’re paying for something kid related.

No matter where you find yourself on the financial spectrum or whether you do or don’t have kids, talking about money with your spouse is a must. Without these discussions, either one of you may spend aimlessly without a care in the world until someday you’re faced with a mountain of debt.

Having a number in mind of how much you feel comfortable spending without causing alarm for your spouse can be a helpful tool to avoid financial mishaps. Again, the number doesn’t have to be $50. Change it to $500 if you’re able. The point is, the number exists and you both agree to it. No more Amazon purchases in the middle of the night or unlimited shopping sprees.

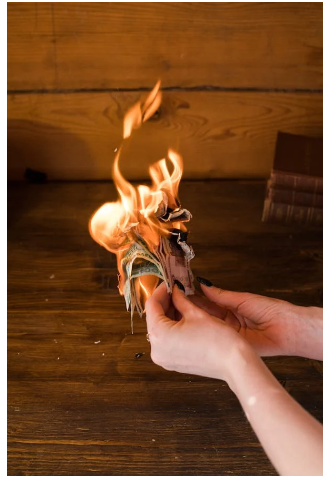

Accountability is hard to swallow but it’s also sometimes necessary for us to reach our goals. It’s equally important for someone besides yourself to hold your feet to the fire for the choices you make. How much more difficult would it be for you to add something to your cart if you knew someone else was holding you accountable for the purchase?

“But I’m single. I don’t have anyone to hold me accountable.” Do you have a parent or a friend? Do you know anyone who would be willing to help you play the “bad guy/girl” to ensure you don’t proceed down the path of bad money choices? Chances are you do and this person(s) could act in the same capacity as a spouse.

Not everyone needs to have someone be the guardian of their purchases. There are plenty of people who can manage just fine on their own, but they’re in the minority. A majority of Americans are either bad with money or spend far too much of it without thinking of the consequences. That needs to stop. All bills come due eventually.

Look at the bright side. With less packages being delivered, you may actually be able to use your front porch.