A new report from Fitch Ratings reveals that a staggering 90% of U.S. metro areas are experiencing overvalued housing markets, with a national average overvaluation of 11.1% at the close of 2023. This trend is particularly acute in South Carolina, which is among the states with the sharpest increase in overvalued homes.

In South Carolina, the median listing price for homes reached $351,370, with an annual home price increase of 9.4%. These high prices, combined with increasing mortgage rates, have created a difficult market for prospective buyers, with many homes selling for significantly more than their asking price.

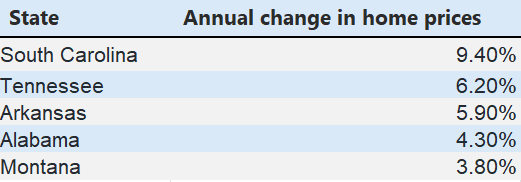

Here are the top five states where homes were most overvalued, according to Fitch Ratings

Several factors have converged to create this challenging real estate landscape:

-

High demand and low supply: Years of underbuilding have resulted in a housing shortage, further exacerbated by high mortgage rates that disincentivize current homeowners from selling. This limited supply, coupled with a strong demand for housing, has driven up home prices.

-

Rising mortgage rates: The average 30-year mortgage rate reached 7.09% as of May 9th, making homeownership less affordable for many potential buyers.

-

Escalating construction costs: The increasing cost of construction materials has made building new homes more expensive, further limiting the available housing supply.

While there are some early signs of market normalization with a recent increase in home listings, the persistently high demand for housing continues to outpace supply, making it a seller’s market in much of the country. This means that in the near future, home prices are likely to remain high, and competition for available properties will remain fierce.